☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

2. Aggregate number of securities to which transaction applies:

|

|

4. Proposed maximum aggregate value of transaction:

5. Total fee paid:GENPREX, INC.

3300 Bee CaveRoad, #650-227, Austin, TX 78746

☐Fee paid previously with preliminary materials.

|

|

1. Amount Previously Paid:

2. Form, Schedule or Registration Statement No.:

3. Filing Party:

4. Date Filed:

GENPREX, INC.

Dell Medical Center, Health Discovery Building

1701 Trinity Street, Suite 3.322, Austin, TX 78712

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

To Be Held On October 1, 2018

Dear Stockholder:be held on December 14, 2023

You are cordially invited to attend the 2018 annual meetingTo Our Stockholders:

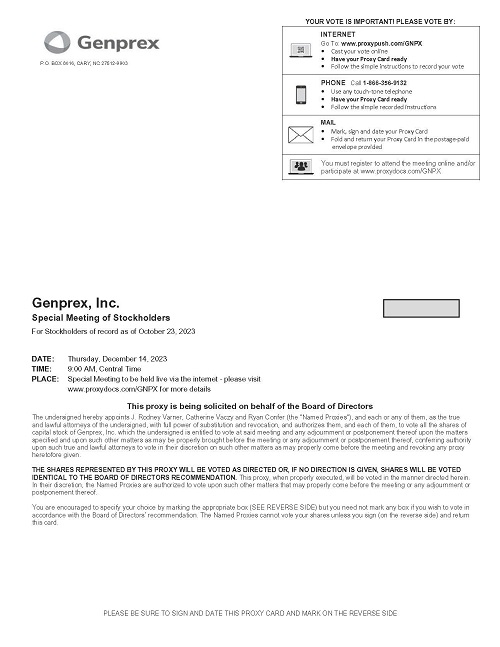

NOTICE IS HEREBY GIVEN that a Special Meeting of stockholdersStockholders (the “Annual“Special Meeting”) of Genprex, Inc., a Delaware corporation (the “Company”). The meeting will be held on Monday, October 1, 2018Thursday, December 14, 2023, beginning at 10:309:00 a.m. (local time)Central Time.

The Special Meeting will be held solely in a virtual meeting format online at www.proxydocs.com/GNPX. You will not be able to attend the offices of W2O Group, 507 Calles Street, Suite 112, Austin, TX 78702, forSpecial Meeting at a physical location.

At the Special Meeting, stockholders will act on the following purposes:matters:

● |

|

● | Proposal 2 - To approve |

|

|

|

|

|

|

These itemsUnder Securities and Exchange Commission (“SEC”) rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of business are more fully described indelivery. On or about November 3, 2023, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials for the Proxy Statement accompanying this Notice.Special Meeting. The Notice also provides instructions on how to vote online and how to receive a copy of the proxy materials by mail or by email.

The record date forPursuant to the Annual Meeting is August 21, 2018. Only stockholders of record atCompany’s Amended and Restated Bylaws (the “Bylaws”), the Board has fixed the close of business on thatOctober 23, 2023 as the record date may vote at the meeting or any adjournment thereof.

By Orderfor determination of the Board of Directors,

/s/ Rodney Varner

Rodney Varner

Chief Executive Officer

Austin, Texas

___________ __, 2018

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the proxy mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

Dell Medical School, Health Discovery Building

1701 Trinity Street, Suite 3.322, Austin, TX 78712

PROXY STATEMENT

FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On October 1, 2018

The Notice of Annual Meeting, this Proxy Statement and form of proxy are first being mailed on or about ______________ __, 2018 to all stockholders entitled to vote at the AnnualSpecial Meeting and any adjournments or postponements thereof.

Your vote is important. Whether or not you plan to attend the Special Meeting, please submit your proxy to vote electronically via the Internet or by telephone, or, if you requested to receive your materials by mail, please complete, sign, date and return the accompanying proxy card or voting instruction card in the enclosed postage-paid envelope. If you attend the Special Meeting and prefer to vote during the Special Meeting, you may do so even if you have already submitted a proxy to vote your shares. You may revoke your proxy in the manner described in the proxy statement at any time before it has been voted at the Special Meeting.

By Order of the Board of Directors, | |

J. Rodney Varner | |

Chief Executive Officer | |

November , 2023 | |

|

THE INFORMATION PROVIDED IN THE “QUESTION AND ANSWER” FORMAT BELOW IS FOR YOUR CONVENIENCE ONLY. YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY.TABLE OF CONTENTS

ABOUT THE MEETING | 1 |

PROPOSAL 1 | 8 |

PROPOSAL 2 | 15 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 16 |

STOCKHOLDER PROPOSALS | 18 |

HOUSEHOLDING OF SPECIAL MEETING MATERIALS | 18 |

OTHER MATTERS | 19 |

Appendix A | A-1 |

GENPREX, INC.

3300 Bee CaveRoad, #650-227, Austin, TX 78746

QUESTIONS AND ANSWERS ABOUT THESEPROXY STATEMENT

This proxy statement contains information related to our Special Meeting of Stockholders to be held on Thursday, December 14, 2023 at 9:00 a.m. Central Time, or at such other time and place to which the Special Meeting may be adjourned or postponed (the “Special Meeting”). The Special Meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend the Special Meeting virtually via the Internet and vote during the meeting by visiting www.proxydocs.com/GNPX. The enclosed proxy is solicited by the Board of Directors (the “Board”) of Genprex, Inc. (the “Company”). The proxy materials relating to the Special Meeting are being made available via the Internet to stockholders entitled to vote at the meeting on or about November 3, 2023. A list of stockholders of record will be available during the 10 days prior to the Special Meeting at the Company’s principal place of business located at 3300 Bee Cave Road, #650-227, Austin, TX 78746. If you wish to view this list, please contact our Corporate Secretary, Catherine Vaczy, at Genprex, Inc., 3300 Bee Cave Road, #650-227, Austin, TX 78746. Such list will also be available for examination by the stockholders during the Special Meeting at www.proxydocs.com/GNPX.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS AND VOTINGFOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 14, 2023: This Notice of Special Meeting of Stockholders, Proxy Statement and the proxy card are available online at: www.proxydocs.com/GNPX. Under Securities and Exchange Commission rules, we are providing access to our proxy materials by notifying you of the availability of our proxy materials on the Internet.

ABOUT THE MEETING

When and where will the Special Meeting be held?

The Special Meeting will be held on December 14, 2023, at 9:00 a.m., Central Time, in a virtual meeting format online at www.proxydocs.com/GNPX, and at any adjournment or postponement thereof. You will not be able to attend the Special Meeting at a physical location. If you plan to attend the Special Meeting, please review the instructions under “How do I attend the AnnualSpecial Meeting?” below.

What is the purpose of the Special Meeting?

We are calling the Special Meeting to seek the approval of our stockholders of the following matters (respectively, “Proposal 1” and “Proposal 2”):

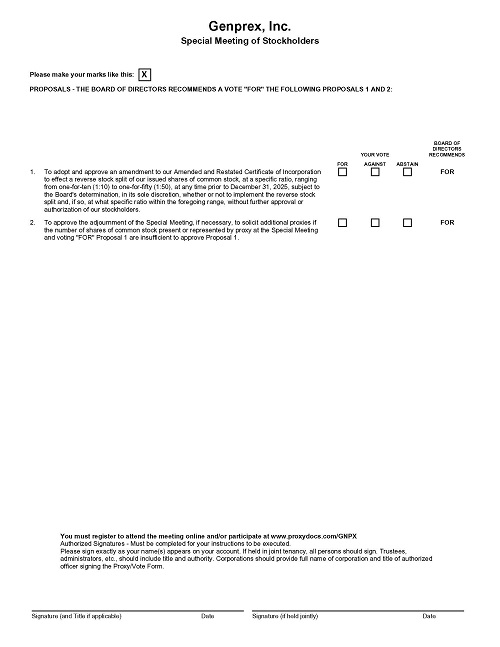

● | To adopt and approve an amendment to our Amended and Restated Certificate of Incorporation (the “Charter”) to effect a reverse stock split of our issued shares of common stock, at a specific ratio, ranging from one-for-ten (1:10) to one-for-fifty (1:50), at any time prior to December 31, 2025, subject to the Board’s determination, in its sole discretion, whether or not to implement the reverse stock split and, if so, at what specific ratio within the foregoing range, without further approval or authorization of our stockholders (the “Reverse Split”); and |

● | To approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies if the number of shares of common stock present or represented by proxy at the Special Meeting and voting “FOR” Proposal 1 are insufficient to approve Proposal 1. |

What are the Board’s recommendations?

The meetingBoard recommends you vote:

● | FOR the Reverse Split and amendment to our Charter effecting the Reverse Split; and |

● | FOR the approval of the adjournment of the Special Meeting, if necessary, to solicit additional proxies if the number of shares of common stock present or represented by proxy at the Special Meeting and voting “FOR” Proposal 1 are insufficient to approve Proposal 1. |

If you are a stockholder of record and you return a properly executed proxy card or submit a proxy to vote over the Internet but do not mark the boxes showing how you wish to vote, your shares will be voted in accordance with the recommendations of the Board, as set forth above.

No other matters may be brought before the Special Meeting.

What constitutes a quorum?

The presence at the Special Meeting, in person (including, in the case of the virtual Special Meeting, by remote communication) or represented by proxy, of one-third (1/3) of the voting power of our stock outstanding on the record date and entitled to vote at the Special Meeting will constitute a quorum for the Special Meeting. Pursuant to the General Corporation Law of the State of Delaware, abstentions will be counted for the purpose of determining whether a quorum is present. If brokers have, and exercise, discretionary authority on at least one item on the agenda for the Special Meeting, uninstructed shares for which broker non-votes occur will constitute voting power present for the discretionary matter and will therefore count towards the quorum.

Why is the Company holding the Special Meeting in virtual format?

This Special Meeting will be held on Monday, October 1, 2018in a virtual meeting format only. The virtual format provides the opportunity for participation by a broader group of our stockholders, while reducing costs associated with planning, holding and arranging logistics for in-person meeting proceedings. Hosting a virtual meeting also (i) enables increased stockholder attendance and participation because stockholders can participate equally from any location around the world, at 10:30 a.m. (local time)little to no cost, and (ii) reduces the environmental impact of this Special Meeting. You will be able to attend the Special Meeting online and submit your questions in advance of the meeting by visiting www.proxydocs.com/GNPX. You also will be able to vote your shares electronically at the offices of W2O Group, 507 Calles Street, Suite 112, Austin, TX 78702. Information on how to vote in person atSpecial Meeting by following the Annual Meeting is discussedinstructions below.

Why did I receive a notice in the mail regarding the Internet Availability of Proxy Materials instead of a full set of proxy materials?

As permitted by the rules of the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the Special Meeting and help to conserve natural resources. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail or electronically, you will not receive a printed or email copy of the proxy materials unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Who canis entitled to vote at the AnnualSpecial Meeting?

Only stockholders of record at the close of business on August 21, 2018 will bethe record date, October 23, 2023, are entitled to receive notice of, and to vote at the Annual Meeting. On this record date, there were 15,071,366 shares of common stock issued and outstanding andthat they held on that date at, the Special Meeting, or any adjournment or postponement thereof. Holders of our common stock are entitled to one vote held by 135 holders of record.per share on each matter to be voted upon.

As of the record date, we had 59,434,822 outstanding shares of common stock.

You do not need to attend the Special Meeting to vote your shares. Shares represented by valid proxies, received in accordance with the time periods specified in this proxy statement and not revoked prior to the Special Meeting, will be voted at the Special Meeting. For instructions on how to change or revoke your proxy, see “May I change or revoke my proxy?” below. For instructions on how to vote, see “How do I vote?” below.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Special Meeting, which as described herein is being conducted in a virtual meeting format online. For instructions on how to attend the virtual Special Meeting, please review the instructions under “How do I attend the Special Meeting?” below.

Do I need to attend the Special Meeting?

No. It is not necessary for you to attend the virtual Special Meeting in order to vote your shares. You may vote by telephone, through the Internet or by mail, as described in more detail below.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record: Shares Registered in Your NameRecord

If on August 21, 2018, your shares wereare registered directly in your name with Genprex’our transfer agent, V StockVStock Transfer, LLC, then you are aconsidered, with respect to those shares, the stockholder of record. As athe stockholder of record, you mayhave the right to directly grant your voting proxy directly to us or to vote in personby remote communication at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the proxy card that may be mailed to you, or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.Special Meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or BankOwner

If on August 21, 2018, your shares wereof our common stock are held not in your name, but rather in ana stock brokerage account ator by a brokerage firm, bank dealer or other similar organization, thennominee, you are considered the beneficial owner of shares held in “street name”name,” and this Proxy Statement and a voting instruction cardthese proxy materials are being forwarded to you by that organization. The

organization holding your accountbroker, bank or nominee which is considered, with respect to bethose shares, the stockholder of record for purposes of voting atrecord. As the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regardingas to how to vote the shares in your account. Youand are also invited to attend the Annualvirtual Special Meeting. However, sincebecause you are not the stockholder of record, you may not vote yourthese shares in personby remote communication at the Annualvirtual Special Meeting unless you request and obtain a validsigned proxy from yourthe record holder giving you the right to vote the shares. If you do not provide the stockholder of record with voting instructions or otherwise obtain a signed proxy from the record holder giving you the right to vote the shares, broker or other agent.non-votes may occur for the shares that you beneficially own. The effect of broker non-votes is more specifically described in “What vote is required to approve each proposal and how are votes counted?” below.

What amHow do I voting on?attend the Special Meeting?

ThereBoth stockholders of record and stockholders who hold their shares in “street name” will need to register to be able to attend the Special Meeting, vote their shares during the Special Meeting, and submit their questions during the Special Meeting live via the Internet by following the instructions below.

If you are three matters scheduled for a vote:stockholder of record, you must:

● | Follow the instructions provided on your Notice to first register at www.proxydocs.com/GNPX by 5:00 p.m. Eastern Time on December 12, 2023. You will need to enter your name, phone number, control number (included on your proxy card), and email address as part of the registration, following which you will receive an email confirming your registration. |

● | On the day of the Special Meeting, if you have properly registered, you will receive an email approximately one-hour prior to the Special Meeting with a unique access URL. To enter the Special Meeting, log in using the unique access URL. |

● | If you wish to vote your shares electronically at the Special Meeting, you may do so by following the instructions below. |

If you are the beneficial owner of shares held in “street name,” you must:

● | Obtain a legal proxy from your broker, bank, or other nominee. |

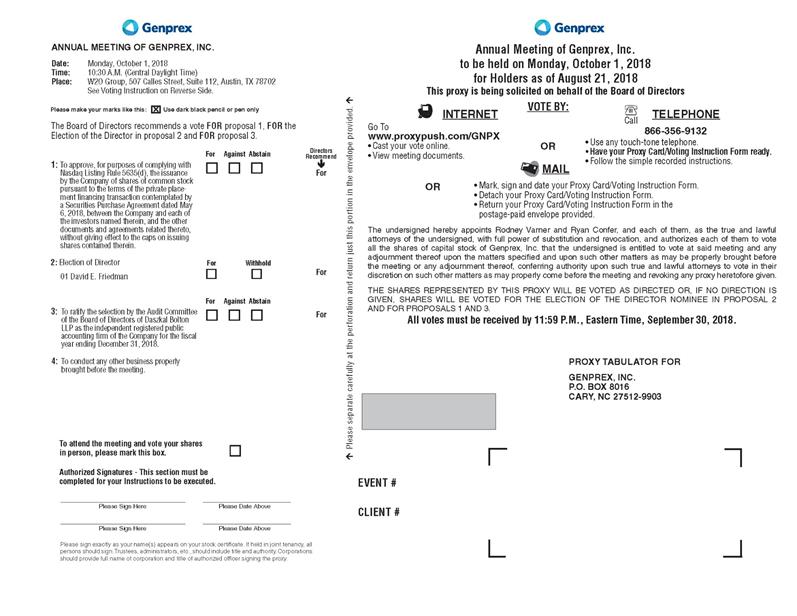

Proposal 1: To approve for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance by the Company of shares of common stock (“Shares”), warrants (“Warrants”) to purchase shares of common stock and shares of common stock to be issued upon exercise of the Warrants (“Warrant Shares”) pursuant to the terms of the private placement financing transaction (“ Private Placement”) contemplated by the Securities Purchase Agreement, dated May 6, 2018 (the “Securities Purchase Agreement”), between the Company and each of the investors named therein, and the other documents and agreements related thereto, without giving effect to the caps on issuing shares contained therein (the “Nasdaq 20% Issuance Proposal ”);

Proposal 2: To elect David E. Friedman as the Class I director to hold office until the 2021 annual meeting of stockholders; and

● | Register at www.proxydocs.com/GNPX by 5:00 p.m. Eastern Time on December 12, 2023. As part of the registration process, you will need to enter your name, phone number, and email address, and provide a copy of the legal proxy (which can be sent via email to the address listed on the registration website), following which you will receive an email confirming your registration and your control number. Please note, if you do not provide a copy of the legal proxy, you may still attend the Special Meeting, but you will be unable to vote your shares electronically at the Special Meeting. |

● | On the day of the Special Meeting, if you have properly registered, you will receive an email approximately one-hour prior to the Special Meeting with a unique access URL. To enter the Special Meeting, log in using the unique access URL. |

Proposal 3: Ratification of the selection by the Audit Committee of our Board of Directors of Daszkal Bolton LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018.

● | If you wish to vote your shares electronically at the Special Meeting, you may do so by following the instructions below. |

What if another matter is properly brought before the Annual Meeting?How do I vote?

The Board of Directors knows of no other mattersWhether you plan to attend the virtual Special Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy card to vote on those mattersvoted in accordance with their best judgment.

How does the Board of Directors recommend I voteyour instructions on the proposals?

The Board recommends a vote:

• FORproxy card or as instructed via the Nasdaq 20% Issuance Proposal;

• FOR the election of David E. Friedman as the Class I director; and

FOR the ratification of the section by the Audit Committee of the Board of Directors of Daszkal Bolton LLP as the independent registered public accounting firm of the CompanyInternet. You may specify whether your shares should be voted for, the fiscal year ending December 31, 2018.

How do I vote?

Withagainst or abstain with respect to the Nasdaq 20% Issuance Proposal,proposals. If you may either vote “For”properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations. Voting by proxy will not affect your right to attend the Special Meeting.

Stockholder of record: shares registered in your name. If your shares are registered directly in your name through our stock transfer agent, VStock Transfer, LLC, or “Against” or abstain from voting. With respectyou have stock certificates registered in your name, you may:

Voting During the Special Meeting:

● | To vote during the live webcast of the Special Meeting, you must first register at www.proxydocs.com/GNPX. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the virtual Special Meeting and to submit questions in advance of the meeting. Please be sure to follow the instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email. |

Voting Prior to the election of Mr. Friedman as the Class I director on the Board of Directors, you may either vote “For” Mr. Friedman to the Board or you may “Withhold” your vote for him. With respect to the ratification of the selection of Daszkal Bolton as the Company’s independent registered public accounting firm, you may vote “For” or “Against” or abstain from voting. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your NameSpecial Meeting:

If you are a stockholder of record, you may authorize a proxy to vote in personon your behalf at the AnnualSpecial Meeting in any of the following ways:

● | Over the Internet. You can submit a proxy to vote your shares via the Internet at www.proxypush.com/GNPX. Proxies submitted via the Internet must be received by 11:59 p.m. Eastern Time on December 13, 2023. Have your proxy card in hand as you will be prompted to enter your control number. |

● | By Mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the Board’s recommendations. Proxies submitted by mail must be received by the close of business on December 13, 2023 in order to ensure that your vote is counted. |

● | By Telephone. To vote over the telephone, dial toll-free 866-356-9132 using any touch-tone telephone and follow the recorded instructions. Your telephone vote must be received by 11:59 p.m. Eastern Time on December 13, 2023. Have your proxy card in hand as you will be prompted to enter your control number. |

Submitting your proxy by proxy over themail, by telephone vote by proxyor through the internetInternet will not prevent you from casting your vote at the Special Meeting. You are encouraged to submit a proxy by mail, by telephone or vote by proxy usingthrough the proxy card enclosed with this Proxy Statement. Whether or notInternet even if you plan to attend the AnnualSpecial Meeting we urge you to vote by proxyvia the virtual meeting website to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

VOTE IN PERSON: You may come to the Annual Meeting and we will give you a ballot when you arrive.

VOTE BY PHONE: To vote over the telephone, dial toll-free 866-356-9132 using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number from the proxy card. Your telephone vote must be received by 11:59 p.m. Eastern Time on September 30, 2018 to be counted.

VOTE BY INTERNET: You may vote by completing an electronic proxy card at www.proxydocs.com/GNPX. You will be asked to provide the control number from the proxy card. Your internet vote must be received by 11:59 p.m. Eastern Time on September 30, 2018 to be counted.

VOTE BY PROXY CARD: To vote using a proxy card, simply complete, sign and date the proxy card enclosed with this Proxy Statement and return it promptly in the envelope we have provided or return it to Proxy Tabulator for Genprex, Inc., P.O. Box 8016, Cary, NC 27512-9903. If you return your signed proxy card to us before the Annual Meeting, we will votethat your shares as you direct.

Beneficial Owner: Shares Registered inare represented at the Name of Broker or BankSpecial Meeting.

If you are a beneficial owner ofBeneficial owner: shares registered in the name of your brokerage firm, bank, dealerbroker, or other agent,nominee. If your shares are held in “street name” (held in the name of a bank, broker, or other holder of record), you should have received votingwill receive instructions from that organization rather than from Genprex. Simplythe holder of record. You must follow the voting instructions providedof the holder of record in order for your shares to be voted.

Even if you plan to attend the Special Meeting live via the Internet, we encourage you to vote in advance by the organization to ensureInternet, telephone, or mail so that your vote is counted. Alternatively,will be counted if you may vote by telephone or overlater decide not to attend the internet as instructed by your broker or bank. To vote in person atSpecial Meeting live via the Annual Meeting, you must obtain a valid proxy from your brokerage firm, bank, dealer or other agent. Follow the instructions from your broker or bank, or contact your broker or bank to request a proxy form.Internet.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on August 21, 2018.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or in person at the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the Nasdaq 20% Issuance Proposal, “For” the election of David E. Friedman as the Class I director and “For” the ratification of the selection by the Audit Committee of our Board of Directors of Daszkal Bolton LLP as the independent registered public accounting firm of the Company for the fiscal

year ending December 31, 2018. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner and do not instruct your brokerage firm, bank, dealer or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered to be a “routine” matter under applicable rules. Brokers and nominees can use their discretion to vote uninstructed shares with respect to matters that are considered to be routine under applicable rules, but not with respect to non-routine matters. Under applicable rules and interpretations, non-routine matters are matters that may substantially affect the rights or privileges of stockholders, including the Nasdaq 20% Issuance Proposal and elections of directors (even if not contested). Accordingly, without your instructions your broker or nominee may not vote your shares on Proposal 1 or Proposal 2, but may vote your shares on Proposal 3.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks, dealers or other agents for the cost of forwarding proxy materials to beneficial owners.

What if I Receive More Than One Proxy Card or Voting Instruction Form?

If you hold your shares in multiple accounts or registrations, or in both registered and street name, you will receive a proxy card or voting instructions form for each account. Please sign, date and return all proxy cards you receive from the Company. If you choose to vote by proxy via the telephone or the Internet, please vote once for each proxy card you receive. Only your latest dated proxy for each account will be voted.

What if I have questions about my Genprex shares or need to change my mailing address?

You may contact our transfer agent, V Stock Transfer, LLC, by telephone at (855) 9VSTOCK or, or by email at info@vstocktransfer.com if you have questions about your Company shares or need to change your mailing address.

CanMay I change my vote after submittingor revoke my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You canmay revoke your proxy or change your vote at any time before the final voteproxy is exercised at the AnnualSpecial Meeting. If you are the record holder of your shares, youYou may change or revoke your proxy in any one of the following ways:

● | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

You may submit another properly completed

● | by re-voting over the Internet as instructed above; |

● | by notifying our Corporate Secretary, Catherine Vaczy, in writing before the Special Meeting that you have revoked your proxy; or |

● | by attending the virtual Special Meeting and voting at the meeting. Attending the virtual Special Meeting will not in and of itself revoke a previously submitted proxy. |

Your most current vote, whether by Internet, telephone, or proxy card with a later date.

You may grant a subsequent proxy by telephone or through the internet.

You may send a timely written notice that you are revoking your proxy to Genprex’s Secretary at Genprex, Inc., Dell Medical School, Health Discovery Building, 1701 Trinity Street, Suite 3.322, Austin, TX 78712.

You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. Your most recent proxy card or telephone or internet proxy is the one that will be counted. For purposes of submitting your vote over the Internet before the Special Meeting, you may change your vote until 11:59 p.m. Eastern Time on December 13, 2023. At this deadline, the last vote submitted will be the vote that is counted.

Beneficial Owner: Shares Registered in However, simply attending the Name of Brokervirtual Special Meeting without voting will not revoke or Bankchange your proxy.

If your shares are held by your brokerage firm, bank, dealer or other agent as a nominee, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in the Company’s proxy materials for next year’s annual meeting, your proposal must be submitted in writing by December 28, 2018.

If you wish to submit a proposal (including a director nomination) that is not to be included in the Company’s proxy materials for next year’s annual meeting, you must do so not later than the close of business 90 days, nor earlier than the close of business 120 days, prior to the first anniversary of the date of the 2018 Annual Meeting. In the event the date of the 2019 annual meeting is more than 30 days before or more than 30 days after such anniversary date, notice must be delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. You are also advised to review the Company’s amended and restated bylaws, which contain additional requirements relating to advance notice of stockholder proposals and director nominations.

Proposals should be addressed to:

Genprex, Inc.

Attn: Corporate Secretary

Dell Medical School, Health Discovery Building

1701 Trinity “Street Suite 3.322

Austin, TX 78712

What are “broker non-votes”?

When a beneficial owner of shares held in “street name” does not give instructions to the brokerage firm, bank, dealer or other agent holding the shares as to how to vote on matters deemed to be non-routine under applicable rules, the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How are votes counted and how many votes are needed to approve each proposal?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will tabulate the votes at the Annual Meeting and will separately count:

With respect to the Nasdaq 20% Issuance Proposal, votes “For” and “Against,” abstentions and broker non-votes;

With respect to the proposal to elect David E. Friedman as the Class I director, votes “For,” “Withhold” and broker non-votes; and

With respect to the proposal to ratify the Audit Committee’s selection of Daszkal Bolton LLP as our independent public accounting firm, votes “For” and “Against,” abstentions and broker non-votes.

The affirmative vote of the holders of a majority of the shares of our common stock presentshould contact their bank, broker, trust or represented byother nominee to obtain instructions as to how to revoke or change their proxies.

What if I receive more than one notice or proxy and entitledcard?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How do I vote?” for each account to ensure that all of your shares are voted.

What vote on the matter is required to approve each proposal and how are votes counted?

At the Nasdaq 20% Issuance Proposal. In addition, for Nasdaq purposes,Special Meeting, an inspector of elections will determine the Nasdaq 20% Issuance Proposal requires approval bypresence of a majorityquorum and tabulate and certify the results of the voting by stockholders. Assuming that a quorum is present (see “What constitutes a quorum?” above), the following votes will be required:

● | With respect to the proposal to adopt and approve an amendment to our Charter to authorize the Board in its discretion to effect the Reverse Split (Proposal 1), the affirmative vote of a majority of the votes cast by all stockholders present in person (including by remote communication) or represented by proxy at the virtual Special Meeting and entitled to vote on the proposal is required to approve this proposal. Shares that are not represented at the Special Meeting, abstentions, if any, and, if this proposal is deemed to be “non-routine,” broker non-votes with respect to this proposal will not affect the outcome of the vote on this proposal. If Proposal 1 is deemed to be “routine” (which we believe likely to be the case), no broker non-votes will occur on this proposal; see “What is a ‘broker non-vote’?” and “Will my shares be voted if I do not vote?” below. |

● | With respect to the proposal to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are insufficient votes to approve Proposal 1 (Proposal 2), the affirmative vote of a majority of the shares present or represented by proxy at the Special Meeting and entitled to vote on the proposal is required to approve this proposal. Abstentions, if any, will have the effect of votes against this Proposal 2. Shares that are not represented at the Special Meeting and, if this proposal is deemed to be “non-routine,” broker non-votes with respect to this proposal will not affect the outcome of the vote on this proposal. If Proposal 2 is deemed to be “routine” (which we believe likely to be the case), no broker non-votes will occur on this proposal; see “What is a ‘broker non-vote’?” and “Will my shares be voted if I do not vote?”below. |

Under the General Corporation Law of the State of Delaware, holders of the common stock will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the meeting, providedmeeting.

What is a “broker non-vote”?

Banks, brokers, and other agents acting as nominees are permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine” by the investors inNew York Stock Exchange, which means that they can submit a proxy or cast a ballot on behalf of stockholders who do not provide a specific voting instruction. Brokers and banks are not permitted to use discretionary voting authority to vote proxies for proposals that are deemed “non-routine” by the Private Placement shallNew York Stock Exchange. The determination of which proposals are deemed “routine” versus “non-routine” may not be entitledmade by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As such, it is important that you provide voting instructions to your bank, broker or other nominee, if you wish to ensure that your shares are present and voted at the Special Meeting on all matters and if you wish to direct the voting of your shares on “routine” matters.

A broker non-vote occurs when there is at least one “routine” matter to be considered at a meeting and a broker submits a proxy to vote eitheron at least one “routine” proposal but does not vote on a given proposal because the Shares ownedbroker does not have discretionary power for that particular item and has not received instructions from the beneficial owner on that proposal.

Under the applicable rules governing brokers, we believe the proposals (i) to adopt and approve an amendment to our Charter to effect the Reverse Split at the discretion of the Board (Proposal 1), and (ii) to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are insufficient votes to approve Proposal 1 (Proposal 2), are each likely to be considered “routine” matters. If such proposals are “routine,” a bank or broker may be able to vote on Proposal 1 and Proposal 2 even if it does not receive instructions from you, so long as it holds your shares in its name. If, however, Proposal 1 or Proposal 2 is deemed by them or the Warrant Shares underlying Warrants owned by them, which are the Shares and WarrantsNew York Stock Exchange to purchase our common stock that were issued to the investors pursuant to the Securities Purchase Agreement. If you mark your proxy as “Abstain” on the Nasdaq 20% Issuance Proposal, or if you give specific instructions that no vote be cast on any specifica “non-routine” matter, the shares represented by that proxybrokers will not be voted on that matter, but will count in determining whether a quorum is present. Broker non-votes have no effect toward the vote total for the Nasdaq 20% Issuance Proposal. Abstentions will have the effect of an “Against” vote on the Nasdaq 20% Issuance Proposal because abstentions are considered shares entitledpermitted to vote on this proposal. With respectany such proposal to the Nasdaq 20% Issuance Proposal,extent deemed “non-routine” if athe broker has not received instructions from the beneficial owner.

Will my shares be voted if I do not vote?

If you are the stockholder is aof record, your votes will not be counted if you do not vote as described above under “How do I vote?” above. If you are the beneficial owner of shares held in street name such stockholder’sand you do not provide voting instructions to the bank, broker, or other nominee will not be permittedthat holds your shares, the bank, broker, or other nominee that holds your shares has the authority to vote such stockholder’syour unvoted shares only on matters that are considered to be “routine” by the approvalNew York Stock Exchange. As described above, we believe that the proposals (i) to adopt and approve an amendment to our Charter to effect the Reverse Split at the discretion of the Nasdaq 20% IssuanceBoard (Proposal 1), and (ii) to approve the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are insufficient votes to approve Proposal unless the bank or broker receives voting instructions from such stockholder.

For the election of directors, the nominees receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. The only nominee for Class I director1 (Proposal 2), are each likely to be considered at“routine” matters by the Annual Meeting is Mr. Friedman. Only votes “For” will affect the outcome of Proposal 2.

To be approved, the ratification of the selection of Daszkal Bolton LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2018, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter.New York Stock Exchange. If you “Abstain” from voting, it will haveare the same effect as an “Against” vote. Broker non-votes, if any, will have no effect.

As a reminder, if you are a beneficial owner of shares held in street name, in orderwe encourage you to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your bank, broker, bank or other agent by the deadline provided in the materials you receive fromnominee. This ensures your broker, bank or other agent.

What is the quorum requirement?

A quorum of stockholders is necessary to hold the Annual Meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Annual Meeting in person or represented by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your brokerage firm, bank, dealer or other agent) or if you vote in personvoted at the Annual Meeting. AbstentionsSpecial Meeting and broker non-votes will be counted towardsin the quorum requirement. If there is no quorum, the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.manner you desire.

HowWhere can I find out the voting results of the voting at the AnnualSpecial Meeting?

PreliminaryThe preliminary voting results will be announced at the Annual Meeting. In addition,Special Meeting, and we will publish final voting results will be published in a Current Report on Form 8-K that we expect to filefiled with the SEC within four business days afterof the AnnualSpecial Meeting. If final voting results are not available to us inunavailable at the time towe file athe Form 8-K, within four business days after the Annual Meeting,then we intend towill file aan amended report on Form 8-K to publish preliminarydisclose the final voting results and, within four business days after the final voting results are known to us, file an additional Form 8-K to publish the final results.known.

PROPOSAL 1

NASDAQ 20% ISSUANCE PROPOSALHow are we soliciting this proxy?

Private PlacementWe are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. Some of our officers, directors and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or other electronic means.

On May 9, 2018,

We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the capital stock and to obtain proxies.

In addition, we have engaged Alliance Advisors, LLC to assist in the solicitation of proxies and provide related informational support, for a services fee, which is not expected to exceed $15,000.

PROPOSAL 1: ADOPTION AND APPROVAL OF AN AMENDMENT TO OUR CHARTER TO EFFECT A REVERSE STOCK SPLIT OF OUR ISSUED SHARES OF COMMON STOCK, AT A SPECIFIC RATIO, RANGING FROM ONE-FOR-TEN (1:10) TO ONE-FOR-FIFTY (1:50), AT ANY TIME PRIOR TO DECEMBER 31, 2025, SUBJECT TO THE BOARD’S DETERMINATION, IN ITS SOLE DISCRETION, WHETHER OR NOT TO IMPLEMENT THE REVERSE STOCK SPLIT AND, IF SO, AT WHAT SPECIFIC RATIO WITHIN THE FOREGOING RANGE,

WITHOUT FURTHER APPROVAL OR AUTHORIZATION OF OUR STOCKHOLDERS

Overview

Our Board has determined that it is advisable and in the best interests of the Company and its stockholders for us to amend our Charter to effect a reverse stock split (the “Charter Amendment”) of our issued an aggregateshares of 828,500common stock at a specific ratio, ranging from one-for-ten (1:10) to one-for-fifty (1:50) (the “Approved Split Ratios”), at any time prior to December 31, 2025, subject to the Board’s determination, in its sole discretion, whether or not to implement the reverse stock split and, if so, at what specific ratio within the foregoing range, without further approval or authorization of our stockholders (the “Reverse Split”). A vote for this Proposal 1 will constitute adoption and approval of the Charter Amendment and the Reverse Split that, once effected by filing the Charter Amendment with the Secretary of State of the State of Delaware, will combine between ten and fifty shares of our common stock (the “Shares”) at a purchase price of $12.07 perinto one share (the “Per Share Purchase Price”) and warrants to purchase up to 621,376 shares of our common stock (the “Warrants”) with an initial exercise price equal to $15.62 per share (the “Exercise Price”), in a private placement (the “Private Placement”) in accordance with a securities purchase agreement (the “Securities Purchase Agreement”) entered into with certain institutional and accredited investors (collectively,stock. If implemented, the “Purchasers”) on May 6, 2018. The Per Share Purchase Price andReverse Split will have the Exercise Price were subject to adjustment as described below. The total consideration paid to us in the Private Placement was approximately $10,000,000. When issued, the Warrants were exercisable on the earliereffect of six months from the issuance date or the date of effectiveness of the registration statement registering the underlying shares for resale, in each case subject to ownership limitations described below, and expire five years from such date. The Warrants are exercisable on a cashless basis six months after the issuance date if there is then no effective registration statement registering the resale of the shares underlying the Warrants. The $10,000,000 purchase price paid by the Purchasers on May 9, 2018 represents the entire purchase price that will be paid by the Purchasers for the Shares and the Warrants, even if additional Shares are issued and additional Warrant Shares become issuable following a Triggering Event discussed below. If the Warrants are exercised in full on a cash basis, we will receive an additional $9,705,893.

We engaged Maxim Group, LLC (“Maxim”) as our exclusive placement agent in connection with the Private Placement. Network 1 Financial Securities, Inc. served as an advisor in connection with the transaction.

When the Shares and Warrants were issued, the Per Share Purchase Price of the Shares, the Exercise Price of the Warrants and the number of Warrant Shares were subject to adjustment based on the lowest volume weighted average price (“VWAP”) for the three trading days (the “VWAP Calculation”) immediately following each of the following events (“Triggering Events”): (i) the date that a registration statement covering the resale of the Shares issued in the Private Placement has been declared effective by the SEC, (ii) if a registration statement covering all Shares issued in the Private Placement is not declared effective, then the date that the Shares can be sold under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), and (iii) if later than the dates set forth in item (i) and (ii), then the date that our stockholders approve the Nasdaq 20% Issuance Proposal. Following a Triggering Event, the Per Share Purchase Price for the Shares would automatically be reduced, if applicable, to 85% of the lowest of the three VWAPs in the VWAP Calculation, and we would be required to issue to the Purchasers additional Shares to reflect the adjustment to the Per Share Purchase Price so that the total number of Shares issued pursuant to the Securities Purchase Agreement would equal $10,000,000 divided by the Per Share Purchase Price, as adjusted; provided that the Per Share Purchase Price could not be reduced to less than $4.25 per Share and could not be adjusted upward. In addition, following a Triggering Event, the Exercise Price of the Warrants would automatically be reduced, if applicable, to 110% of the lowest of the three VWAPs in the VWAP Calculation;

provided, that in no event would the Exercise Price for the Warrants be reduced to less than $4.25 or increased as a result of an adjustment. In the event the Exercise Price of the Warrants were adjusted, then the total number of Warrant Shares issuable upon exercise of the Warrants would be increased so that the total exercise price payable to exercise the Warrants after the adjustment is equal to the total exercise price payable to exercise the Warrants before such adjustment. As a result, the maximum number of securities that could be issued under the Securities Purchase Agreement is 2,352,940 Shares and Warrants to purchase an aggregate of 2,283,740 Warrant Shares, based on an adjusted Per Share Purchase Price of $4.25 per share and a Warrant Exercise Price of $4.25 per share.

On May 22, 2018, our Registration Statement on Form S-1 (File No. 333-225090) (the “Registration Statement”) was filed with the Securities and Exchange Commission, or SEC, to register the resale of up to 2,352,940 Shares and up to 2,283,740 Warrant Shares. On July 26, 2018, the Registration Statement was declared effective by the SEC. As a result of the effectiveness of the Registration Statement, the Warrants became exercisable on July 26, 2018, subject to ownership limitations. The Per Share Purchase Price and the Warrant Exercise Price were both adjusted to $4.25 per share, based on a VWAP of $3.5299 on July 27, 2018. On August 1, 2018, pursuant to the terms of the Securities Purchase Agreement and the Warrants, we issued to the Purchasers an aggregate of 1,174,440 additional Shares, and the Warrants became exercisable for a total of 2,283,740 Warrant Shares, with an exercise price equal to $4.25 per Warrant Share. An additional 350,000 Shares are issuable to one of the Purchasers in the Private Placement upon the request of such Purchaser under the terms of the Securities Purchase Agreement.

Until stockholder approval of the Nasdaq 20% Issuance Proposal is obtained, the total number of Shares issuable pursuant to the Securities Purchase Agreement, plus the total number of Warrant Shares issuable upon exercise of the Warrants, shall not exceed 19.99% ofdecreasing the number of shares of our common stock outstanding immediately before the closing of the Private Placement. The 828,500 Shares initially issued, to the Purchaser under the Securities Purchase Agreement and the 1,174,440 Shares issued on August 1, 2018 following the effectiveness of the Registration Statement, together constitute 13.29% of the number of shares of our common stock that were outstanding immediately before the closing of the Private Placement.

The securities issued pursuant to the Securities Purchase Agreement were issued under the exemption from registration provided by Section 4(a)(2) of the Securities Act and the rules and regulation promulgated thereunder, including Regulation D.

Registration Rights

In connection with the Private Placement, we entered into a registration rights agreement (the “Registration Rights Agreement”) with the Purchasers. Pursuant to the Registration Rights Agreement, we agreed to prepare and file a registration statement (the “Resale Registration Statement”) with the SEC by May 21, 2018 for purposes of registering the resale by the Purchasers of up to 2,352,940 Shares and up to 2,283,740 Warrant Shares. We also agreed to use our reasonable best efforts to cause the Resale Registration Statement to be declared effective by the SEC by June 25, 2018 (or July 10, 2018 in the event of a full review by the SEC).

The Registration Rights Agreement includes provisions for liquidated damages for failure to meet the specified filing and effectiveness deadlines or keep the Resale Registration Statement effective, subject to certain permitted exceptions. Under the Registration Rights Agreement, we have agreed to keep the Resale Registration Statement effective at all times until the earlier of (i) the date as of which the Investors may sell all of the securities covered by such registration statement without volume or manner-of-sale limitations pursuant to Rule 144 (or any successor thereto) promulgated under the Securities Act or (ii) the date on which the Investors shall have sold all of the securities covered by the Resale Registration Statement.

On May 10, 2018, we filed with the SEC a Current Report on Form 8-K (the “Form 8-K”) that described the terms of the Private Placement. We filed as exhibits 4.1, 10.1 and 10.2 to the Form 8-K the form of Warrant, the

Securities Purchase Agreement and the form of Registration Rights Agreement. We refer you to the Form 8-K and the exhibits thereto for a further description of the Private Placement.

The Registration Statement was deemed filed on May 22, 2018, and was declared effective by the SEC on July 26, 2018.

Nasdaq Rule 5635(d)

Nasdaq Rule 5635(d) requires stockholder approval prior to an issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by a company of common stock equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance for less than the greater of book and market value of our common stock as of the time of execution of the definitive agreement with respect to such transaction. The provisions in (i) the Securities Purchase Agreement that prevent the issuance of Shares if such issuance will result in such holders beneficially owning in excess of 19.99% of our common stock (the “Beneficial Ownership Limitation”) prior to stockholder approval and (ii) the Warrants that prevent exercise of the Warrants prior to stockholder approval to the extent the issuance of Warrant Shares pursuant to such exercise, when combined with the issuances of Shares pursuant to the Securities Agreement, would be in excess of the Beneficial Ownership Limitation, are both required under Nasdaq Rule 5635(d). We are seeking stockholder approval for the sale and issuance of such Shares and Warrant Shares in connection with the Private Placement pursuant to Nasdaq Rule 5635(d) without regard to the Beneficial Ownership Limitation.

Consequences if Stockholder Approval is Not Obtained

If we do not obtain approval of the Nasdaq 20% Issuance Proposal at the Annual Meeting, we are obligated under the Securities Purchase Agreement to call a stockholder meeting every four months thereafter to seek approval of the Nasdaq 20% Issuance Proposal from our stockholders until the earlier of the date such approval is obtained or the Warrants are no longer outstanding. In addition, so long as any Warrants are outstanding, we may not issue any capital stock or equity instruments in a capital raising transaction until we obtain stockholder approval of the Nasdaq 20% Issuance Proposal. If we do not obtain stockholder approval, the maximum number of shares that will be issuable pursuant to the Private Placement will not exceed 2,612,378 shares, which equals 19.99% of the number of outstanding shares of our common stock on May 5, 2018.

Description of Proposal

We are seeking stockholder approval as required by Nasdaq Rule 5635(d) (as described above) to enable the us to issue a number of shares our common stock in connection with the Private Placement that exceeds 20% of the number of shares of our common stock that were outstanding before the Private Placement, which shares include the Shares issued pursuant to the Securities Purchase Agreement and the Warrant Shares issuable upon exercise of the Warrants, consisting of:

a total of 2,352,940 Shares issuable pursuant to the Securities Purchase Agreement; and

• a total of 2,283,740 Warrant Shares issuable upon exercise of the Warrants.

Related Parties

Except for the sale and issuance of the Shares and the Warrants, the participants in the Private Placement have not had any material relationship with us within the past three years, other than Maxim, which served as the placement agent for the Private Placement, and Network 1 Financial Securities, Inc., which was the underwriter of our initial public offering and served as an advisor for the Private Placement. As compensation for serving as

placement agent for the Private Placement, we paid to Maxim a fee of $700,000 and reimbursed Maxim’s related expenses.

Vote Required

The affirmative vote of the holders of a majority of the shares of our common stock present in person or represented by proxy and entitled to vote on the matter, excluding shares acquired in the Private Placement under the Securities Purchase Agreement, is necessary under Nasdaq Marketplace Rule 5635(e)(4) to approve the Nasdaq 20% Issuance Proposal. Broker non-votes will not affect whether this proposal is approved, but abstentions will have the sameno effect as a vote against the proposal.

In accordance with applicable Nasdaq Marketplace Rules, holders of the shares of our common stock purchased in the Private Placement are not entitled to vote such shares on the Nasdaq 20% Issuance Proposal.

Prior to the closing of the Private Placement, and as a condition to such closing, certain of our stockholders entered into voting agreements with the Purchasers. As of immediately prior to the closing of the Private Placement, the stockholders executing the voting agreements owned approximately 62% of our total issued and outstanding common stock. Pursuant to the voting agreements, the stockholder signatories agreed to vote all shares of our common stock owned by them in favor of the Nasdaq 20% Issuance Proposal.

Potential Effects of this Proposal

The issuance of the shares of our common stock which are the subject of the Nasdaq 20% Issuance Proposal will result in an increase in the number of shares of common stock outstanding. This will result in a decreasewe are authorized to issue.

Accordingly, stockholders are asked to adopt and approve the respective ownership and voting percentage interests of stockholders prior to the Private Placement. The market value of our Company and our future earnings may be reduced.

In addition, as described above under “Registration Rights,” we have registered the securities issued in the Private Placement, which includes a total of 4,636,680 shares of our common stock, consisting of a maximum of 2,352,940 Shares issued or issuable pursuant to the Securities Purchase Agreement and 2,283,740 Warrant Shares that could become issuable upon exercise of Warrants. The release of up to 4,636,680 freely traded shares onto the market, or the perception that such shares will or could come onto the market, has had and could have an adverse effect on the trading price of our stock.

We have broad discretion to use the net proceeds to us from the sale of such shares, including the proceeds received upon exercise of the Warrants, and you will be relying solely on the judgment of our Board of Directors and management regarding the application of these proceeds. Our use of the proceeds may not improve our operating results or increase the value of your investment.

For your consideration of the Nasdaq 20% Issuance Proposal, a description of the material terms of the Private Placement isCharter Amendment set forth in this proxy statementAppendixA to provide you with basic information concerningeffect the Private Placement. However,Reverse Split as set forth in the description above isCharter Amendment, subject to the Board’s determination, in its sole discretion, whether or not a substitute for reviewingto implement the full textReverse Split and, if so, at what specific ratio within the range of the referenced documents, which were attached as exhibitsApproved Split Ratios, provided that if implemented, the Reverse Split must be effected on or prior to December 31, 2025. As set forth on Appendix A, by approving this Proposal 1, the stockholders will be deemed to have adopted and approved an amendment to effect the Reverse Split at each of the Approved Split Ratios.

If adopted and approved by our Current Report on Form 8-K asstockholders, the Reverse Split (if implemented in the Board’s sole discretion) would be effected at an Approved Split Ratio approved by the Board prior to December 31, 2025, if at all. If the Reverse Split is implemented by the Board, the Charter Amendment setting forth the Approved Split Ratio approved by the Board will be filed with the SEC on May 10, 2018.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR”

THE APPROVAL OF THE NASDAQ 20% ISSUANCE PROPOSAL.

ELECTION OF CLASS I DIRECTOR

Our BoardSecretary of Directors is divided into three classes. Each class consists of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The Board presently has three members. There is one Class I director, David E. Friedman, whose term of office expires in 2018. Proxies may not be voted for a greater number of persons than the one nominee, Mr. Friedman, named in this proxy statement. Mr. Friedman, a current director of the Company, was recommended for nomination to the Board at the Annual Meeting by the Nominating and Corporate Governance Committee of the Board. If elected at the Annual Meeting, Mr. Friedman would serve until the 2021 annual meeting of stockholders and until his successor has been duly elected and qualified, or, if sooner, until his death, resignation or removal. It is the Company’s policy to invite directors and nominees for director to attend the Annual Meeting.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Accordingly, the nominee receiving the highest number of affirmative votes will be elected. The only nominee for Class I director to be considered at the Annual Meeting is Mr. Friedman. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Mr. Friedman. If Mr. Friedman becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by the Company. Mr. Friedman has agreed to serve if elected. The Company’s management has no reason to believe that Mr. Friedman will be unable to serve.

Nominee

The Nominating and Corporate Governance Committee seeks to assemble a Board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the Nominating and Corporate Governance Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board. The biographies below include information, as of the date of this Proxy Statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Nominating and Corporate Governance Committee to believe that that nominee should continue to serve on the Board. However, each member of the Nominating and Corporate Governance Committee may have a variety of reasons why he believes a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

Nominee for Election for a Three-Year Term Expiring at the 2021 Annual Meeting

David E. Friedman, 55, has served as a member of our Board since August 2012. Since August 2010, Mr. Friedman has served as a partner of TCG Group Holdings, an Austin, Texas based SEC-registered investment advisor to separately-managed institutional and private client accounts. In addition, since January 2012, Mr. Friedman has served as a managing partner of ACM Investment Management, which manages hedge fund assets acquired from KeyCorp, the bank holding company parent of KeyBank. From 2006 to 2010, Mr. Friedman

served as the Chief Operating Officer of Austin Capital Management, which was owned by KeyCorp, where he led the company’s non-investment functions, including all legal, finance, investor relations, technology and operations teams. Before joining Austin Capital, Mr. Friedman was a Director on the Global Prime Brokerage desk of Citigroup in New York, and an associate at the law firm of Proskauer Rose in its New York headquarters. Mr. Friedman received his BS in management from Tulane University and his JD from Duke University School of Law. He is admitted to the BarState of the State of New YorkDelaware and holds FINRA Series 4, 7, 24 and 63 securities registrations.

Our Nominating and Corporate Governance Committee and Board believe that Mr. Friedman’s unique and valuable mix of high-level and relevant finance, legal and operations experience makes him a well-rounded business leader and a valuable member of our Board.

THE BOARD OF DIRECTORS RECOMMENDS

THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF MR. FRIEDMAN

AS THE CLASS I DIRECTOR.

Director Continuing in Office Untilany amendment to effect the 2019 Annual Meeting

Robert W. Pearson, 56, has served as a member of our Board since July 2012. In June 2009, Mr. Pearson joined W2O Group, a global network of complementary marketing, communications, research and development firms, and has held a number of senior positions at W2O Group, including Chief Technology Officer, President and since February 2017, Vice Chair and Chief Innovation Officer. From March 2012 to February 2017, Mr. Pearson served as President of W2O, and from June 2009 to March 2012 as its Chief Technology & Media Officer. From 2007 to 2009, Mr. Pearson served as Dell Inc.’s Vice President, Communities and Conversations, and before that as its Vice President, Corporate Group Communications. From 2003 to 2006, Mr. Pearson served as Head of Global Corporate Communications and as Head of Global Pharma Communications at Novartis Pharmaceuticals, where he also served on the Pharma Executive Committee. Before joining Novartis, Mr. Pearson served as President, The Americas and Chair, Healthcare Practice for GCI Group, a global public relations consultancy, and was responsible for creating and building the firm’s global healthcare practice. Mr. Pearson previously served as Vice President of Media and Public Affairs at Rhone-Poulenc Rorer, or RPR (now Sanofi-Aventis) and worked at RPR and Ciba-Geigy in communications and pharmaceutical field sales. Mr. Pearson holds a BA from the University of North Carolina at Greensboro and an MBA from Fairleigh Dickinson University.

Our Nominating and Corporate Governance Committee and Board believe that Mr. Pearson’s senior management experience at international pharmaceutical companies and public relations/ investor relations firms, as well as with start-up businesses, and his knowledge and personal contacts in the pharmaceutical industry, and his business management acumen, make him a valuable member of our Board.

Director Continuing in Office Until the 2020 Annual Meeting

J. Rodney Varner, 61, is a co-founder of Genprex and has served as our Chief Executive Officer and Secretary, and as a member of our Board and as Chairman of our Board since August 2012. Mr. Varner also served as our President until April 10, 2018. Mr. Varner served as a partner of the law firm Wilson & Varner, LLP, since 1991. Mr. Varner has more than thirty-five years of legal experience with large and small law firms, and as outside general counsel of a Nasdaq listed company. Mr. Varner has represented for-profit and non-profit companiesReverse Split at the other Approved Split Ratios will be abandoned. The Board or senior management levels in a wide variety of contractual, business, tax and securities matters, including technology transfers, licensing, collaboration and research agreements, clinical trial contracts, pharmaceutical and

biologics manufacturing and process development contracts, state and federal grants, including NIH and SBA grants, corporate governance and fiduciary issues, and real estate matters. Mr. Varner served as counsel in company formation, mergers and acquisitions, capital raising, other business transactions, protection of trade secrets and other intellectual property, real estate, and business litigation. Mr. Varner is a member ofreserves the State Bar of Texas and has been admittedright to practice beforeelect to abandon the United States Court of Appeals for the Fifth CircuitCharter Amendment and the United States Tax Court. Mr. Varner received his BBA, with high honors, from Texas A&M University and his J.D. from The University of Texas School of Law.

Our Nominating and Corporate Governance Committee and Board believe that Mr. Varner’s broad legal experience, as well as his position of Chief Executive Officer of the Company, qualifies him to serve as a member of our Board.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of the Board of Directors

Under the listing requirements and rules of The Nasdaq Capital Market, independent directors must constitute a majority of a listed company’s Board within 12 months after its initial public offering. In addition, the rules of The Nasdaq Capital Market require that, subject to specified exceptions and phase-in periods following its initial public offering, each member of a listed company’s audit, compensation and nominating and governance committee be independent, and that a listed company’s audit committee must haveReverse Split at least three members and a listed company’s compensation committee must have at least two members. Under the rules of The Nasdaq Capital Market, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

We intend to rely on the phase-in rules of The Nasdaq Capital Market with respect to the independence of our Board and the Audit Committee. In accordance with these phase-in provisions, our Board and the Audit, Compensation, and Nominating and Corporate Governance Committees have at least two independent members, and all members will be independent within one year of the effective date of the registration statement relating to the initial public offering of our common stock.

Audit committee members must also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act, or Rule 10A-3. To be considered to be independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of a company’s audit committee, the company’s Board or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Our Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, our Board has determined that other than Rodney Varner, our CEO who serves on the Board as the Chairman, each of our directors does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the listing requirements and rules of The Nasdaq Capital Market and under the applicable rules and regulations of the SEC. In making this determination, our Board considered the current and prior relationships that each non-employee director has with us and all other facts and circumstances our Board deemed relevant in

determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Leadership Structure

Our Chief Executive Officer, Rodney Varner, also currently serves as the Chairman of our Board. The Board does not currently have a lead independent director. We believe that the leadership structure of our Board is appropriate at the present time, in light of the small size of our Board. We believe that the fact that two of the three members of the Board are independent reinforces the independence of the Board in its oversight of our business and affairs, and provides for objective evaluation and oversight of management’s performance, as well as management accountability. In addition, we have a separate chair for each committee of the Board. The chair of each committee is expected to report to the Board from time to time, or whenever so requested by the Board, on the activities of his committee in fulfilling its responsibilities as detailed in its respective charter or specify any shortcomings should that be the case.

Role of the Board in Risk Oversight

The Audit Committee of our Board is primarily responsible for overseeing our risk management processes on behalf of our Board. Going forward, we expect that the Audit Committee will receive reports from management on at least a quarterly basis regarding our assessment of risks. In addition, the Audit Committee reports regularly to our Board, which also considers our risk profile. The Audit Committee and our Board focus on the most significant risks we face and our general risk management strategies. While our Board oversees our risk management, management is responsible for day-to-day risk management team processes.

Meetings of the Board of Directors

The Board met three times and acted by unanimous written consent four times during 2017. All directors attended at least 75% of the aggregate number of meetings of the Board during 2017. The Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee did not meet in 2017.

INFORMATION REGARDING COMMITTEES OF THE BOARD OF DIRECTORS

On September 25, 2017, in anticipation of our initial public offering, which occurred on March 29, 2018, our Board established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. Our Board may establish other committees to facilitate the management of our business. The composition and functions of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board.

Audit Committee